Having “grown up” in the telecom and IT technology industries, I’m accustomed to looking into the future, seeking out pockets of innovation, and finding the nascent markets that will create big brand opportunities.

But in the last few weeks, I’ve come to believe the next billion-dollar brand will not come from IT but rather, cannabis, and that brand is likely growing in a greenhouse near you.

Follow The Money

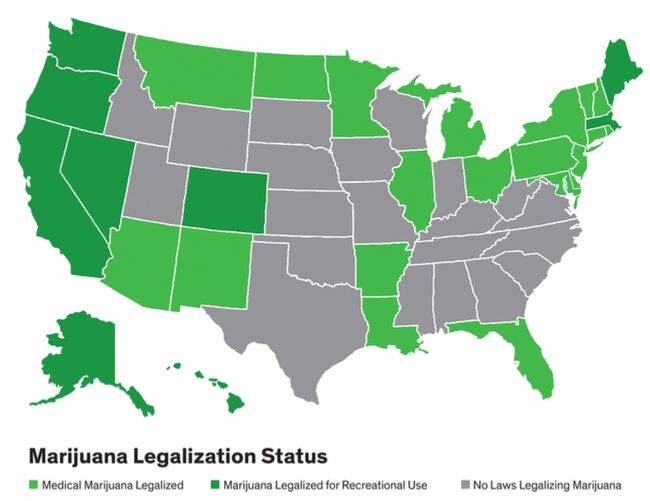

Ultimate Federal legal status remains unresolved, but cannabis is now legal for medical or recreational use in 29 states and the District of Columbia. And the investment community has taken notice. A few weeks ago, I attended the Viridian Capital Advisors conference in NYC (held, ironically, at the John Jay College of Criminal Justice!). There were 300+ people in attendance, lots of interesting press coverage, and we heard from some of the companies that have raised over $1B in venture financing in 2016. Legal cannabis sales in 2016 were $6.7B and expected to grow to almost $23B by 2020. Some estimates are that the total cannabis market (legal and illegal) is closer to $150B. The key take-away, though, is that this is the first multi-billion-dollar market in history that needs no demand generation! It’s already there and just needs to be coaxed out from the shadows and into the light.

It’s an Ecosystem Play

Key to understanding the brand opportunity in this space, is recognizing that this isn’t just about the plant. Viridian and others are tracking two categories in general: those that “touch the plant” (growers, edibles, etc.) and those that “don’t touch the plant” (lighting, real estate, technology, etc). Certainly, there will be huge consumer-related brands and brand-houses, just as happened with beer and alcohol (think: Diagio). But with a patchwork of legal markets today, and Federal prohibitions on interstate commerce still in place, the ability of these companies to invest in brand and marketing is limited. The more immediate potential is in these peripheral markets that don’t touch the plant but support those who do: real estate, lighting, environmental controls, lab testing/certification, etc. These businesses will draft off the momentum of cannabis but also have other legal markets they can serve.

Parallels to IT Markets

In particular, there is a fascinating parallel between cannabis and the data center/cloud/hosting/co-location market that BrandFoundations has served for years. An October 2016 opinion piece in Data Center Dynamics (Why Not Diversify Into Dope?) explains how both data centers and cannabis growing facilities require large real estate footprints, careful environmental controls, tremendous amounts of primary and backup power, and ironclad security. At yesterday’s CAPRE Data Center Summit in NYC, I struck up a conversation with the folks at Stultz, an HVAC vendor to data centers who have authored a white paper on the topic and are starting to market a medical-grade solution for the space.

The Need for Clear Brand Messaging and Positioning

All this points to a potentially huge opportunity, but one with serious brand and communications implications. First, as we’ve seen in the data center market, consolidation is inevitable. There is already an increasing level of cannabis M&A activity and when companies start combining, there is a strong need for aligning the people around a common story.

Source: Viridian Capital Advisors

Second, given decades of negative impressions and the sensitivity of cannabis being only a partially legal market, brand positioning and messaging will be paramount. Brands from other markets looking to enter the cannabis sector – even if they are not touching the plant – will need to clearly articulate why this is a natural extension of their core business, what their value proposition is and why the upside potential outweighs any potential downside risks. And those brands that do touch the plant will need to find ways to connect with a large variety of audiences, leveraging natural archetypal personalities and building “brand houses” to appeal to traditional recreational users and newer medical audiences who will have very different aspirations and motivations.

In a future post we’ll take a look at some of the early brands we’re tracking in this space and how they are leveraging these strategies to potentially become that next billion-dollar brand.

In the meantime, if you are thinking about starting or extending your brand into this sector, give us a shout and we'll help make sure you craft the right story.